Hyperface Dashboard

2022

Hyperface, is a fintech company facilitating collaboration between brands and banks. One of it’s project required the design of a customer experience section for an application enabling brand managers to easily customize and build products such as credit cards, statements, and SMS notifications for their customers.

Brief

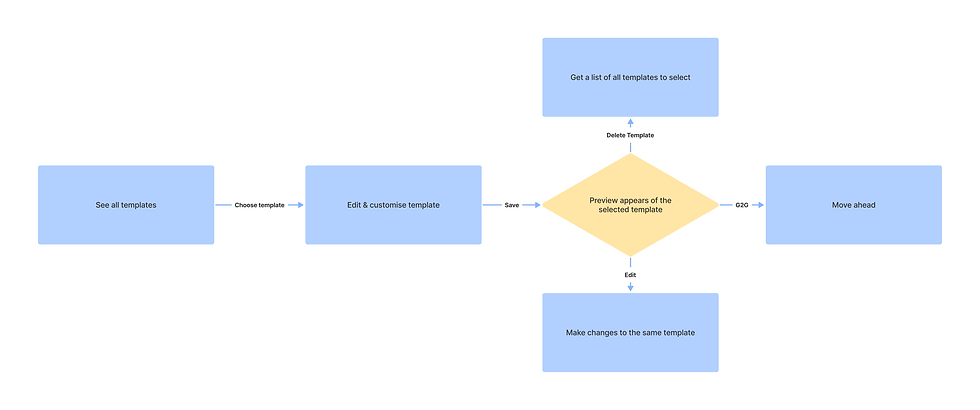

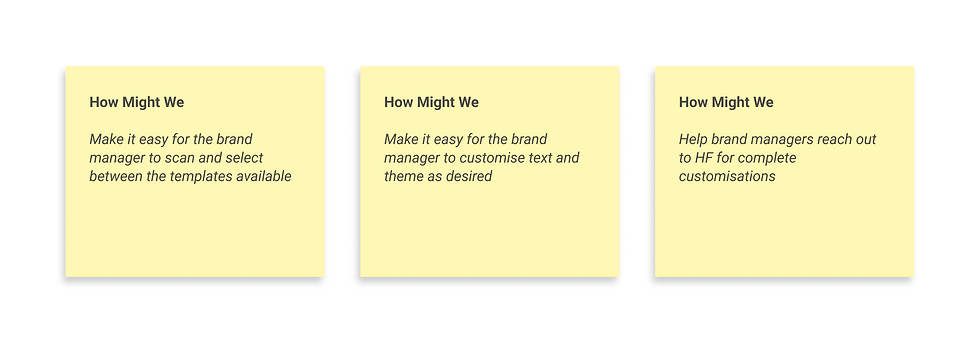

Understanding the requirements and constraints of both brands and banks was crucial. The initial step involved developing a basic flow for manager interactions in creating these customer experiences. Key "How Might We" questions were established to guide the design process, ensuring the final designs addressed all identified needs and potential challenges.

Approach

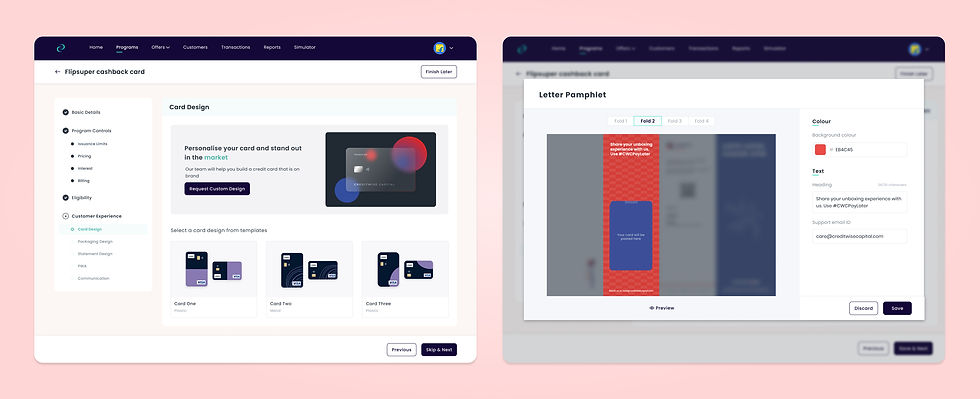

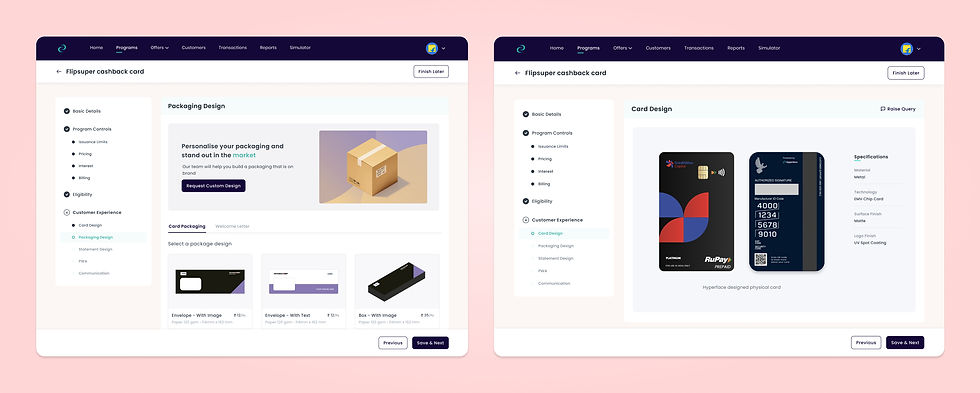

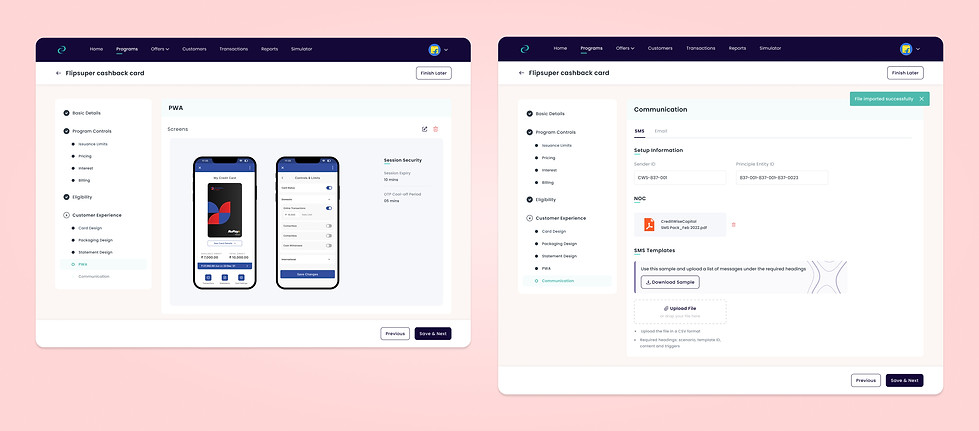

The project included the creation of several key screens, detailed in the project link provided. The process of creating these screens highlighted three significant learnings:

Interface

Managers needed a high degree of customization to tailor products to specific brand requirements. Thus, the interface incorporated modular design elements, allowing for easy modifications and ensuring brand consistency across different products.

1. Customization and Flexibility

The design prioritized a seamless user experience. This was achieved through clear, logical navigation paths and interactive elements that guided managers through the product creation process without confusion.

2. Intuitive User Experience

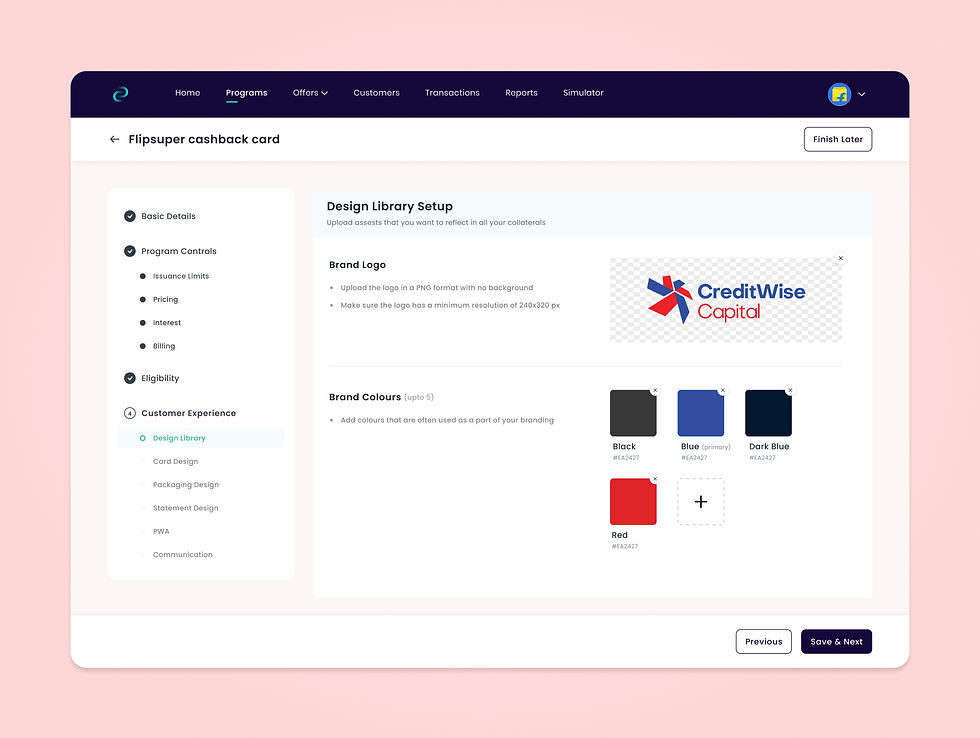

Although not initially part of the requirements, a design library was proposed. This feature was intended to provide a seamless experience for managers as they created collaterals. By allowing managers to store and reuse design elements such as colors and logos, the design library streamlined the creation process and maintained brand uniformity across various customer-facing materials.

3. Design Library Integration

The project was a collaborative effort by myself and a colleague, with direct reporting to the founder. Spanning over two weeks, the effort included a thorough understanding of the specific information required by banks, ensuring alignment with regulatory and operational standards.

Contributions